Article Directory

Alright, so the Dow's supposedly hitting 50,000. The S&P 500 is sniffing at 7000. Nvidia, that darling of the AI-hyped masses, is closing in on five trillion. Five. Trillion. Dollars. You know what? Wake me up when it actually matters.

The Milestone Fatigue is Real

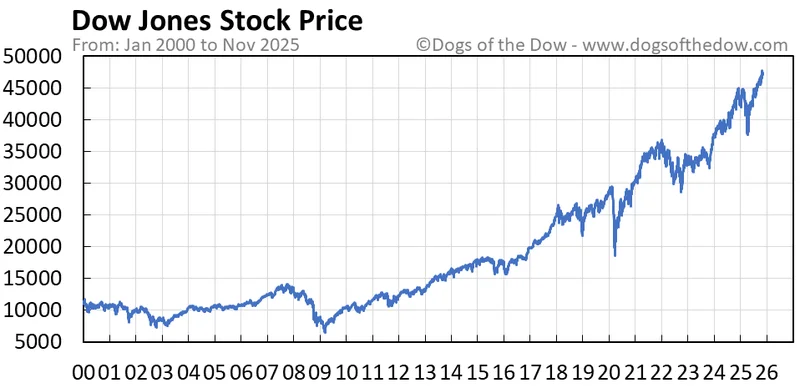

Remember when the Dow first broke 10,000? People lost their damn minds. Champagne corks were flying, CNBC was orgasming live on air. Now? Meh. We've been desensitized. Like a frog slowly boiling in water, we've become numb to the absurdity of these numbers.

The article mentions milestones at 20,000, 30,000, and 40,000 were met with less and less enthusiasm. No kidding. It's like celebrating your 90th birthday – yeah, it's an achievement, but everyone's just waiting for the inevitable.

Financial Times columnist John Authers called Dow 20,000 "fake news" because it supposedly didn't represent the market. I mean, he's not wrong. The Dow is, like, what, 30 companies? It's a completely arbitrary number. It's like judging the health of the entire ocean by looking at a single puddle.

And this whole "AI-fueled bull market" narrative? Give me a break. It's a self-fulfilling prophecy. Everyone's piling into Nvidia because everyone else is piling into Nvidia. It's a digital tulip craze, and when it pops, it's gonna be spectacular. I mean, are we really supposed to believe that AI is going to solve all our problems? Or is it just going to replace us with robots and leave us all unemployed and eating Soylent Green?

The "Good Old Days" Weren't That Great

The Dow started at 40.94 in 1896. It took 103 years to hit 10,000. Now we're talking about 40,000 points gained in a fraction of that time. So what? Does that mean we're all richer? Happier? More secure? Offcourse not. It just means the rich are getting richer, and the rest of us are struggling to afford a decent avocado toast. The Dow Is Close to 50,000. How the Heck Did We Get Here So Fast? - Barron's

The Dow plummeted to 41.22 in 1932. Remember that? Probably not, because most of us weren't alive. But it's a good reminder that what goes up must come down. And this market... this feels unsustainable. This feels like we're building a house of cards on a foundation of sand.

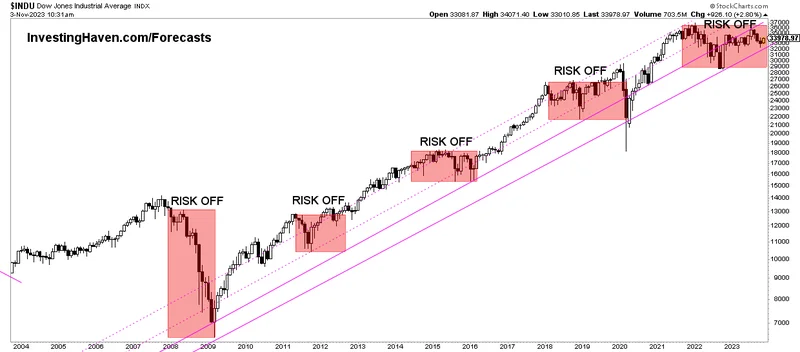

Tobias Levkovich at Citigroup noticed investors stopped worrying about downside risks when the Dow hit 30,000. That's the problem right there. Complacency. Arrogance. A complete lack of historical perspective. It's like driving a car at 100 miles per hour with your eyes closed, thinking nothing bad can happen.

I dunno, maybe I'm just being a grumpy old man yelling at clouds. But this whole thing smells fishy. It smells like greed, and hubris, and a complete disregard for the consequences.

So, What's the Endgame Here?

Look, I ain't saying the market's gonna crash tomorrow. Maybe it'll keep going up. Maybe Nvidia will hit $10 trillion. Maybe we'll all be living in a utopian AI-powered paradise. But let's be real, the writing's on the wall. This isn't sustainable. This isn't healthy. And when the music stops, a lot of people are gonna be left without a chair. And honestly... it's gonna be a goddamn mess.